Talking Wealth :

Introduction

In today’s fast-paced financial landscape, “Talking Wealth” products have become essential tools for managing and growing your finances.

Whether you’re a novice investor or an experienced financial planner, finding the right wealth management solution can be challenging. This blog post aims to simplify your decision-making process by comparing various “Talking Wealth” products across multiple categories. From features and pricing to community support and security, we’ll help you discover the best options to achieve your financial goals.

Features and Tools

When evaluating “Talking Wealth” products, one of the most crucial aspects to consider is the features and tools they offer. These components can significantly impact the user experience and effectiveness of the product in managing and growing your wealth. Here, we’ll delve into the key features and tools provided by various “Talking Wealth” products to help you determine which one best suits your financial needs.

Unique Features

Each “Talking Wealth” product often has unique features designed to set it apart from the competition. For instance, some apps offer real-time market analysis and personalized financial advice, while others might include gamified learning experiences to make financial education more engaging. Understanding these unique features can help you choose a product that aligns with your specific goals and interests.

- Real-time Market Analysis: Provides up-to-date information on stock markets, commodities, and other investment options.

- Personalized Financial Advice: Tailored recommendations based on your financial situation and goals.

- Gamified Learning: Interactive quizzes and simulations to make learning about finance fun and engaging.

Customization Options

Customization options are essential for tailoring the “Talking Wealth” product to your personal financial situation. Look for products that allow you to set personalized goals, track your progress, and adjust settings to match your preferences.

- Personalized Goal Setting: Set and track financial goals such as saving for retirement, buying a home, or paying off debt.

- Adjustable Settings: Customize notifications, dashboards, and other features to suit your needs.

Interactive Tools

Interactive tools are a hallmark of high-quality “Talking Wealth” products. These tools can include budget planners, investment calculators, and risk assessment quizzes, all designed to provide hands-on assistance in managing your finances.

- Budget Planners: Help you create and stick to a budget by tracking income and expenses.

- Investment Calculators: Assist in projecting potential returns on investments based on various scenarios.

- Risk Assessment Quizzes: Evaluate your risk tolerance to help tailor investment strategies.

Integration with Other Platforms

Integration capabilities are another vital feature. The ability to sync your “Talking Wealth” product with other financial platforms (like bank accounts, investment portfolios, and tax software) can streamline your financial management process.

- Bank Account Syncing: Automatically import transactions and balances from your bank accounts.

- Portfolio Integration: Track your investments in real-time by integrating with brokerage accounts.

- Tax Software Compatibility: Simplify tax filing by exporting financial data directly to tax preparation software.

Visualization Tools

Effective visualization tools can transform complex financial data into easy-to-understand charts and graphs. This helps you quickly grasp your financial health and make informed decisions.

- Charts and Graphs: Visualize income, expenses, and investment performance over time.

- Dashboard Overviews: Get a snapshot of your overall financial situation at a glance.

Security Features

Security is paramount when dealing with financial products. Look for “Talking Wealth” products that offer robust security measures such as encryption, two-factor authentication, and regular security audits to protect your sensitive data.

- Encryption: Ensures that your data is securely transmitted and stored.

- Two-Factor Authentication: Adds an extra layer of security to your account.

- Regular Security Audits: Periodic checks to ensure the system is secure against breaches.

Pricing

Pricing is a critical factor when choosing a “Talking Wealth” product. Understanding the cost and what you get for your money can help you make an informed decision. Here, we break down the pricing structures of various “Talking Wealth” products to provide clarity on what each offers.

Cost Comparison

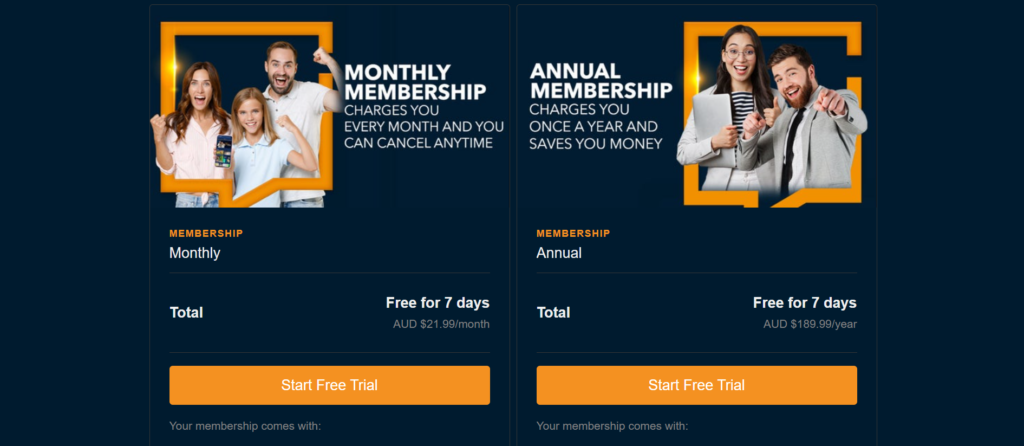

“Talking Wealth” products come with different pricing models. These can range from free basic versions to premium subscriptions. Comparing the costs side by side can help you determine which product offers the best value for your budget.

- Free Versions: Many “Talking Wealth” products offer a free version with basic features. This is a good starting point for those new to wealth management tools.

- One-Time Purchase: Some products require a one-time payment, giving you lifetime access to all features.

- Subscription Plans: Monthly or annual subscription plans are common, providing access to premium features and ongoing updates.

Free vs. Premium Versions

Free versions of “Talking Wealth” products typically offer limited features, making them suitable for beginners or those with simple needs. Premium versions, on the other hand, unlock advanced tools and personalized support, which can be crucial for more complex financial management.

- Basic Features in Free Versions: Budget tracking, simple investment calculators, and basic educational content.

- Advanced Features in Premium Versions: Detailed financial planning, personalized advice, comprehensive market analysis, and exclusive educational resources.

Value for Money

When considering the pricing of “Talking Wealth” products, it’s essential to evaluate the value for money. This involves assessing the range of features, the quality of support, and the overall user experience provided at each price point.

- Feature Set: Ensure that the product includes all the tools you need for effective wealth management.

- Customer Support: Premium plans often come with enhanced customer support, including personalized financial advice and quicker response times.

- Overall Experience: Consider user reviews and testimonials to gauge satisfaction with the product.

Discounts and Offers

Many “Talking Wealth” products provide discounts or special offers, particularly for new users or during promotional periods. Keep an eye out for these deals to get the best possible price.

- Introductory Discounts: Reduced rates for the first few months of subscription.

- Annual Subscription Discounts: Lower monthly costs when you commit to an annual plan.

- Seasonal Offers: Special deals during holidays or financial awareness campaigns.

Community and Support

A strong community and robust support system can significantly enhance the value of “Talking Wealth” products. These aspects provide users with additional resources, help, and motivation to achieve their financial goals. Here, we explore the community and support features offered by various “Talking Wealth” products to help you make an informed decision.

User Forums and Groups

Many “Talking Wealth” products feature user forums and online groups where users can share experiences, ask questions, and provide support to each other. These communities can be incredibly valuable for gaining insights, learning from others’ experiences, and finding solutions to common problems.

- User Forums: Online discussion boards where users can post questions and share advice.

- Social Media Groups: Dedicated groups on platforms like Facebook and LinkedIn for real-time interaction and support.

Availability of Coaching or Mentoring

Some “Talking Wealth” products go beyond self-service resources by offering coaching or mentoring services. These services connect users with financial experts who can provide personalized advice and guidance.

- Personal Coaching: One-on-one sessions with a financial coach to discuss specific financial goals and challenges.

- Mentoring Programs: Access to experienced mentors who can offer advice, share their success stories, and provide ongoing support.

Support Resources

Comprehensive support resources are essential for helping users navigate the features and tools of “Talking Wealth” products. These resources can include FAQs, help centers, tutorials, and live chat support.

- FAQs and Help Centers: Extensive libraries of articles and guides covering common questions and troubleshooting tips.

- Tutorials and Webinars: Step-by-step video tutorials and live webinars to help users maximize the product’s potential.

- Live Chat and Email Support: Direct access to customer support representatives for immediate assistance with technical issues or account questions.

Community Engagement

Active community engagement is a sign of a healthy and supportive ecosystem around a “Talking Wealth” product. Look for products that host regular events, webinars, and interactive sessions to keep users engaged and informed.

- Regular Webinars: Educational webinars on various financial topics, hosted by experts.

- Interactive Sessions: Live Q&A sessions, workshops, and community events to foster engagement and learning.

- User Meetups: In-person or virtual meetups where users can network and share their experiences.

User Testimonials and Success Stories

User testimonials and success stories provide valuable social proof of a “Talking Wealth” product’s effectiveness. These stories can inspire new users and offer insights into how others have successfully used the product to achieve their financial goals.

- Testimonials: Quotes and reviews from satisfied users highlighting their positive experiences.

- Success Stories: Detailed case studies showcasing real-life examples of users who have achieved significant financial milestones using the product.

Security and Privacy

When it comes to “Talking Wealth” products, security and privacy are paramount. These products often handle sensitive financial information, so ensuring your data is protected is crucial. Here, we explore the security and privacy measures implemented by various “Talking Wealth” products to help you choose the safest option.

Data Protection Measures

“Talking Wealth” products use a variety of data protection measures to safeguard user information. These measures are designed to prevent unauthorized access and ensure that your data is secure.

- Encryption: Most “Talking Wealth” products use encryption to protect data both in transit and at rest. This means your information is converted into a secure code that only authorized parties can decode.

- Secure Servers: Data is stored on secure servers with robust physical and digital security measures to prevent breaches.

- Regular Backups: Regular data backups ensure that your information is safe and can be restored in case of data loss or corruption.

User Privacy Policies

A clear and comprehensive user privacy policy is a key indicator of a trustworthy “Talking Wealth” product. These policies outline how your data is collected, used, and protected.

- Transparency: Look for products with transparent privacy policies that clearly explain what data is collected and how it is used.

- Data Minimization: The best “Talking Wealth” products collect only the information necessary to provide their services, minimizing the risk of data exposure.

- User Control: Users should have control over their data, including the ability to access, modify, and delete their information.

Compliance with Regulations

Compliance with data protection regulations is crucial for any “Talking Wealth” product. These regulations set the standards for data privacy and security, ensuring that your information is handled responsibly.

- GDPR Compliance: For products used in the European Union, compliance with the General Data Protection Regulation (GDPR) is essential. This regulation gives users greater control over their personal data.

- CCPA Compliance: In the United States, compliance with the California Consumer Privacy Act (CCPA) ensures that users’ data privacy rights are protected.

- Other Regulations: Depending on the region, there may be additional regulations that “Talking Wealth” products must adhere to, ensuring comprehensive data protection.

Two-Factor Authentication

Two-factor authentication (2FA) is an extra layer of security that many “Talking Wealth” products offer. This feature requires users to verify their identity using two different methods, typically a password and a code sent to their mobile device.

- Enhanced Security: 2FA significantly reduces the risk of unauthorized access by requiring a second form of verification.

- Easy Setup: Most “Talking Wealth” products make it easy to set up 2FA, providing clear instructions and support.

Regular Security Audits

Regular security audits are crucial for maintaining the integrity of “Talking Wealth” products. These audits involve comprehensive checks of the product’s security measures to identify and address potential vulnerabilities.

- Third-Party Audits: Independent security firms often conduct these audits to ensure unbiased assessments.

- Continuous Monitoring: Ongoing monitoring helps detect and respond to security threats in real time.

- Audit Reports: Some “Talking Wealth” products provide users with audit reports, offering transparency about their security practices.

Pros and Cons

When choosing a “Talking Wealth” product, understanding the pros and cons is essential to making an informed decision. Each product has its strengths and weaknesses, which can influence how well it meets your financial needs. Here, we break down the advantages and disadvantages of various “Talking Wealth” products to help you decide which one is right for you.

Pros

Comprehensive Financial Tools “Talking Wealth” products often provide a wide range of financial tools, from budgeting and investment calculators to retirement planners and debt management tools. These comprehensive features can help you manage all aspects of your financial life in one place.

User-Friendly Interface Many “Talking Wealth” products are designed with user experience in mind, featuring intuitive interfaces that make it easy to navigate complex financial information. A user-friendly design ensures that both beginners and advanced users can effectively use the product.

Educational Resources A key benefit of “Talking Wealth” products is the wealth of educational resources they offer. From articles and videos to webinars and interactive courses, these resources can enhance your financial literacy and help you make informed decisions.

Personalized Financial Advice Some “Talking Wealth” products offer personalized financial advice based on your unique financial situation and goals. This tailored approach can provide valuable insights and recommendations to help you achieve your financial objectives.

Community Support Access to a supportive community is another significant advantage. User forums, social media groups, and live Q&A sessions can provide additional guidance, support, and motivation from peers and experts alike.

Cons

Cost While many “Talking Wealth” products offer free versions, advanced features often come with a cost. Subscription fees or one-time purchase prices can add up, especially if you need access to premium features and personalized advice.

Complexity Some “Talking Wealth” products can be overwhelming due to their complexity. With a multitude of features and tools, it can take time to learn how to use the product effectively, especially for beginners.

Data Privacy Concerns Given the sensitive nature of financial information, data privacy is a significant concern. Users must trust that the product has robust security measures in place to protect their data, which can be a barrier for some individuals.

Limited Customization While many “Talking Wealth” products offer customization options, they may not always meet specific needs. Limited flexibility in customizing financial plans and tools can be a drawback for users with unique financial situations.

Dependence on Internet Access Most “Talking Wealth” products require an internet connection to access features and updates. This dependency can be a disadvantage for users who prefer offline access or who have unreliable internet connections.

Conclusion

Choosing the right “Talking Wealth” product can have a profound impact on your financial well-being. By carefully evaluating the features, pricing, community support, security measures, and the overall pros and cons of each option, you can make an informed decision that best suits your needs.

Summary of Findings

“Talking Wealth” products offer a range of tools and resources to help you manage your finances effectively. Key features such as personalized financial advice, comprehensive financial tools, and robust educational resources make these products valuable for both beginners and experienced users. However, it’s important to consider potential drawbacks, such as cost and data privacy concerns, to ensure you choose a product that aligns with your financial goals and preferences.

Recommendations

Based on your unique financial situation and needs, here are a few recommendations:

- For Beginners: Look for products with user-friendly interfaces and strong educational resources to build your financial literacy.

- For Advanced Users: Choose products offering advanced financial tools and personalized advice to optimize your financial strategies.

- For Budget-Conscious Users: Start with free versions and consider upgrading only if you need additional features.

- For Privacy-Conscious Users: Prioritize products with robust security measures and clear privacy policies to protect your sensitive information.

Final Thoughts on “Talking Wealth” Products

Investing time in selecting the right “Talking Wealth” product can pay off significantly in the long run. Whether you are just starting on your financial journey or looking to fine-tune your existing strategies, the right tools can provide invaluable support and guidance.

Stay informed, take advantage of community resources, and always prioritize your security and privacy. With the right “Talking Wealth” product, you can confidently navigate your financial future and achieve your wealth management goals.

Call to Action

We invite you to share your experiences with “Talking Wealth” products in the comments below. Which tools have you found most helpful? What features do you value the most? Your insights can help others make informed decisions. Don’t forget to subscribe to our blog for more tips, reviews, and updates on the best financial tools available. Together, let’s make informed choices and achieve our financial goals.